Mongolia International Capital Corporation

Founded in 2005, Mongolia International Capital Corporation (MICC) is celebrated as Mongolia’s first full-service investment bank and brokerage firm.

A tripartite memorandum of understanding was signed to implement a solar energy project in Dornogovi Province

The Governor's Office of Dornogovi Province, “MICC Securities” LLC, and “Guekhen Dalai” LLC officially signed a tripartite memorandum of understanding today to cooperate on the implementation of a solar energy project.

What we do

Investment Banking

MICC provides comprehensive advisory and capital markets solutions, designed to meet the unique needs of companies and sovereigns.

Brokerage Services

Our Brokerage Division offers seamless access to Mongolian and international equity and fixed income markets, delivering tailored execution, research-driven insights, and best-in-class trading solutions.

Asset Management

Supported by a global network of leading investors and financial institutions, we provide expert portfolio management, alternative investment solutions, and comprehensive wealth advisory services.

Research & Analytics

MICC Research is dedicated to delivering timely, impartial and integrated analysis on companies, economies, market trends and ESG developments.

Select Transactions

STOREPAY

MICC acted as the underwriter to Storepay bond and raised bonds worth MNT 2 billion from retail and institutional investors.

- Industry Fintech

- Transaction type Bond Financing

- Amount MNT 8 billion

- Financing

- Year

M BANK

In 2022, M Bank became Mongolia’s first fully digital bank after obtaining a banking license. Wholly owned by MCS Holding LLC, the bank is building an ecosystem that maximizes customer experience by offering innovative and seamless financial and lifestyle products and services for both individuals and businesses. MICC has successfully raised MNT-denominated financing from foreign investors.

- Industry Banking

- Transaction type Debt Financing

- Amount

- Financing

- Year

GEM TRADE

MICC acted as the underwriter to Gemtrade bond and raised bonds worth MNT 43 billion from retail and institutional investors.

- Industry Distribution

- Transaction type Bond Financing

- Amount MNT 43 billion

- Financing

- Year

DEVELOPMENT BANK OF MONGOLIA

MICC served as the financial advisor for the Development Bank of Mongolia's (DBM) successful bond issuance, facilitating the launch of Mongolia’s first floating-rate bonds and attracting foreign investment in Mongolian Tugrik (MNT). The issuance raised MNT 707 billion across five trades, with MNT 219 billion from floating-rate bonds and MNT 488 billion from fixed-rate bonds.

- Industry Banking

- Transaction type Bond Financing

- Amount MNT 707 billion

- Financing

- Year

PREMIUM PROJECT

MICC secured green financing for the Lapland Villa residential project, developed by Premium Project LLC. The project features a modern, energy-efficient building constructed with high-quality Finnish spruce wood and sustainable design solutions, setting a benchmark for eco-friendly residential developments in Mongolia.

- Industry Construction

- Transaction type Green Debt Financing

- Amount MNT 7 billion

- Financing

- Year

ULAANBAATAR CITY

As part of the Vision-2050, Mongolia's long-term development policy, initiatives were undertaken to establish reliable energy sources to meet domestic electricity demands, enhance engineering networks, and alleviate traffic congestion through infrastructure projects. To finance these objectives, public bonds were issued, MICC worked as a leading underwriter facilitating the process.

- Industry Infrastructure

- Transaction type Municipal Bond

- Amount MNT 500 billion

- Financing

- Year

SKY CHARTER MONGOLIA

MICC acted as a financial advisor to Sky Charter Mongolia LLC, successfully arranging EUR 7 million in ECA financing. This funding supports the company's growth and operational development while leveraging international credit resources for local business advancement.

- Industry Aviation

- Transaction type ECA Financing

- Amount EUR 7 million

- Financing

- Year

TOSON ENERGY

Toson Energy LLC developed a 22 MW thermal power plant, leveraging coal resources from the Mogoin Gol and Ovoot deposits. The project aimed to provide electricity to the Altai-Uliastai region and thermal energy to the Tosontsengel soum center. The plant became operational by the end of 2024. MICC worked as an underwriter to secure the necessary financing for constructing the overhead power transmission line critical to the project.

- Industry Infrastructure

- Transaction type Bond Financing

- Amount MNT 34 billion

- Financing

- Year

GOVERNMENT OF MONGOLIA

MICC advised the Government of Mongolia in finalizing an Investment Agreement with Orano Mining SAS for the Zuuvch Ovoo uranium project. The project will produce 4% of global uranium output, helping diversify Mongolia’s exports, strengthen diplomatic ties, and create approximately 700 jobs, with a total investment of US$ 1.6 billion.

- Industry Mining

- Transaction type Advisory Services

- Amount US$ 1.6 billion

- Financing

- Year

DESERT SOLAR POWER ONE LLC

DSPO operates a 30 MW on-grid solar power plant in Sainshand, Mongolia, which began operation on October 17, 2020. The plant generates over 50,000 MWh of electricity annually, reducing greenhouse gas emissions by 14,994 tons and coal consumption by 6,589 tons each year. MICC played a key role in securing US$ 10 million in working capital for the project through Khan Bank.

- Industry Renewable Energy

- Transaction type Green Debt Financing

- Amount US$ 10 million

- Financing

- Year

BOGD BANK IPO

MICC acted as the sole underwriter for Bogd Bank’s IPO—the first bank IPO since the introduction of the new banking law in 2021. Established in 2014, Bogd Bank focuses on delivering value-added services through advanced technology and aims to become Mongolia’s leading digital bank, aligning with international banking standards.

- Industry Banking

- Transaction type IPO

- Amount MNT 31.75 billion

- Financing

- Year

ММС POLARIS

MICC secured financing from IFC for the development of the Ibis Styles Ulaanbaatar Hotel, part of the global Accor Group with over 4,100 hotels worldwide. Operated under Accor’s internationally recognized brand, the hotel introduces global hospitality standards to Mongolia and strengthens Ulaanbaatar’s capacity to serve both business and leisure travelers.

- Industry Hospitality

- Transaction type Debt Financing

- Amount US$ 6.5 million

- Financing

- Year

ERDENES TAVAN TOLGOI JSC

MICC served as financial advisor and underwriter for Erdenes Tavantolgoi JSC, one of Mongolia’s top five companies and the operator of the strategic Tavan Tolgoi coal deposit. MICC supported the company in raising funding to implement its 2021–2025 business expansion plan, contributing to the growth of one of the country’s most significant state-owned enterprises.

- Industry Mining

- Transaction type Bond

- Amount MNT 731.5 billion

- Financing

- Year

MONGOLIAN RAILWAY

MICC advised on the USD 283 million bond financing for the planned 415 km Tavantolgoi–Zuunbayan railway project. Designed to transport up to 15 million tonnes of coking coal annually, the railway will serve as a strategic export route from the Tavantolgoi mine to China.

- Industry Transport

- Transaction type Debt Financing

- Amount MNT 750 billion

- Financing

- Year

GN BEVERAGES

MICC secured financing from the U.S. International Development Finance Corporation (DFC) for GN Beverages, the exclusive bottler and distributor of PepsiCo products in Mongolia. The funding supports the expansion of the company’s bottling and warehousing facilities. MICC had previously secured GN Beverages’ first international loan of USD 6 million from the Overseas Private Investment Corporation (OPIC, now DFC) in 2009.

- Industry Beverage

- Transaction type Debt Financing

- Amount US$ 7.7 million

- Financing

- Year

MONGOL MICRON CASHMERE

MICC secured financing from DFA for Mongol Micron Cashmere, one of Mongolia’s leading wool and cashmere processing companies operating since 2005. The company specializes in scouring and dehairing raw materials, supplying processed cashmere and wool to both domestic and international markets.

- Industry Wool and Cashmere

- Transaction type Debt Financing

- Amount US$ 6 million

- Financing

- Year

UB SONGDO HOSPITAL

MICC acted as the sole financial advisor for Ulaanbaatar Songdo Hospital, Mongolia’s first private integrated hospital. The hospital benefited from the unique expertise, advanced technology, and best practices of Bumrungrad International Hospital, a world-renowned healthcare provider, while maintaining a strong market position. MICC supported the hospital’s financing through its own capital and guided its development into Mongolia’s leading specialized surgical and medical facility.

- Industry Healthcare

- Transaction type Restructuring

- Amount US$ 37 million

- Financing

- Year

News and Updates

Here you can find the latest information related to the sector, project and program updates, and organizational activities.

- 01/19/2026

- Мөнхбилэг

- Capital Markets Weekly

Weekly market news 01/19/2026

Highlights of this week’s capital market and economy.

- 01/12/2026

- Мөнхбилэг

- Capital Markets Weekly

Weekly market news 01/12/2026

Highlights of this week’s capital market and economy.

- 01/09/2026

- Мөнхтуул

- Equity research

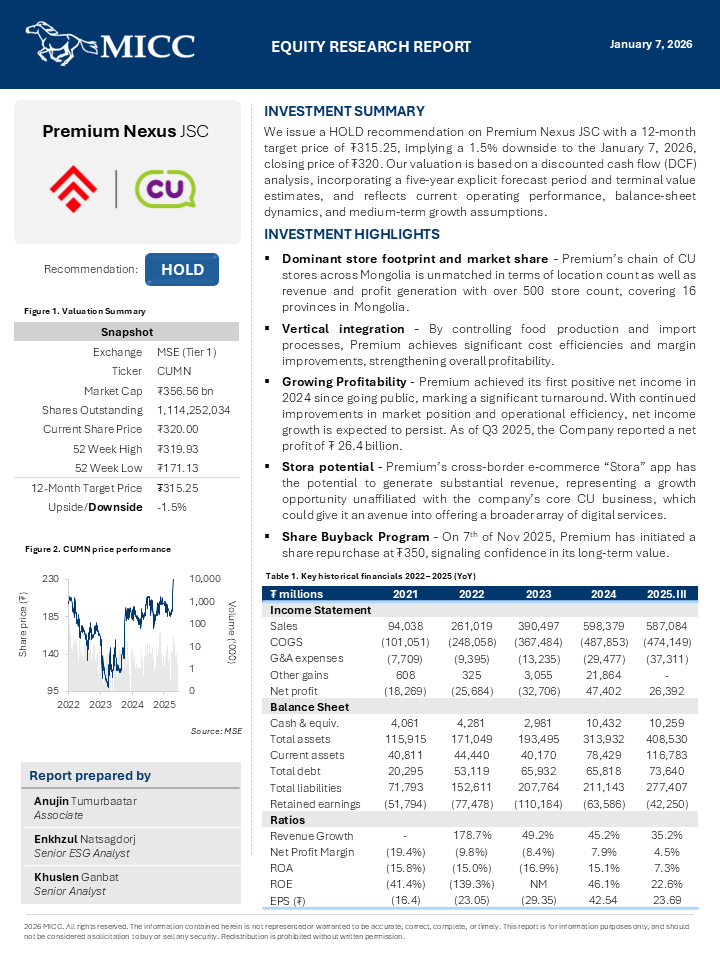

Equity Research: Premium Nexus JSC (MSE: CUMN)

MICC presents its equity research on Premium Nexus JSC (MSE: CUMN)